|

#1

20th February 2012, 09:21 PM

|

|||

|

|||

Detailed structure of Chartered Accountant Course?

sir, please tell me detail structure chartered accountant course ?

|

|

#2

22nd February 2012, 12:52 AM

|

|||

|

|||

|

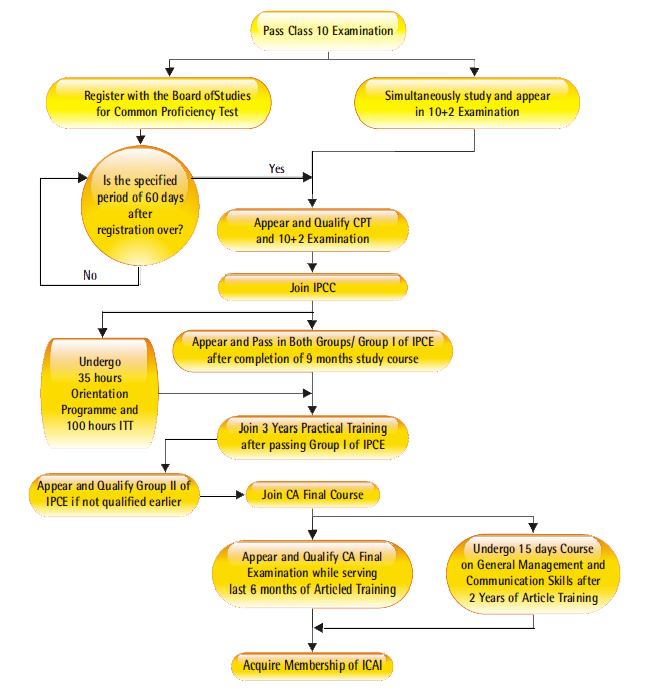

Chartered Accountancy Course, commonly known as CA course is a correspondence

course which is Conducted by Institute of Chartered Accounts of India (ICAI). The ICAI is a Govt. institute which has only rights to conduct this course. Despite being a course of Accounts field, this course doesn't require any relevant background. There is no entrance exam for the course. All those who have completed 12th (any stream), can register for the course. A 12th pass student registered for CA course, first apply for CPT exam. (CPT- Competence Proficiency Test). The syllabus for all the exams are provided by the institute on its website and candidate has to study it on his own completely. Many students who think they require help, take help from private coaching institutes available in all major cities. After passing the CPT exam the candidate is supposed to move for next level of CA course which is IPCC (Integrated Proficiency Competence Course). The IPCC is comprises of Group-A and Group-B. You can apply for Group-A and Group-B at a time or at different times. If you apply for both the groups at a time then after passing the IPCC exam you will have to undergo 3 year Articleship Training under a certified CA. In the last year of Articleship Training, you can apply for CA Final Course exam and with passing the Final course exam, you will be certified as Chartered Accountant. Appearing both the Group A & B of IPCC could be a hectic schedule so if you wish you can join Articleship Training just after passing Group-A and you can appear Group-B anytime between the training period and you can apply for Final course after completion of Articleship training. Visit the ICAI website. http://icai.org/ |

|

#3

22nd February 2012, 01:19 AM

|

|||

|

|||

|

The entry level for all the students is the same. Every student intending to take up the professional accounting course of CA (Chartered Accountancy) has to qualify in

the CPT (Common Proficiency Test). Graduate students are not provided any exemption from appearing at this level. A student is eligible to register for the CPT (Common Proficiency Test) after 10th Standard, but can appear at the examination only after appearing in the 10 + 2 examinations. There is no minimum % marks specified for entry to this level either in the 10th standard examination or the 10 + 2 examination. Moreover, students of any group can take up this course. |

|

#4

22nd February 2012, 04:10 AM

|

|||

|

|||

|

Quote:

Common Proficiency Test- A compulsory test for undergraduates, graduate and post-graduates to get into the Chartered Accountancy course. Integrated Professional Competence Course- Comprise of two groups and candidates qualifying the Common Proficiency Test ate only eligible to register for it. At the time of examination, candidates may write either both the groups or even one. Information Technology Training- Candidates has to go through this training program while pursuing the Integrated Professional Competence Course. Articled Training- Candidates who have qualified at least one group of the Integrated Professional Competence Course may register for a 3 1/2 years of Articled Training. Final course- After qualifying both the groups of the Integrated Professional Competence Course, candidate are eligible to enroll for the Final Course and as far as the Final Examination is concerned, it can be taken after completion of a minimum of 3 years of Articled Training. Management Program- A management program for a short duration, prescribed by the Institute, is mandatory to successfully complete the Chartered Accountancy course. For more information, refer to the official website of Institute of Chartered Accountants of India. |

|

#5

22nd February 2012, 04:23 AM

|

|||

|

|||

|

Quote:

Common Proficiency Test- A compulsory test for undergraduates, graduate and post-graduates to get into the Chartered Accountancy course. Integrated Professional Competence Course- Comprise of two groups and candidates qualifying the Common Proficiency Test ate only eligible to register for it. At the time of examination, candidates may write either both the groups or even one. Information Technology Training- Candidates has to go through this training program while pursuing the Integrated Professional Competence Course. Articled Training- Candidates who have qualified at least one group of the Integrated Professional Competence Course may register for a 3 1/2 years of Articled Training. Final course- After qualifying both the groups of the Integrated Professional Competence Course, candidate are eligible to enroll for the Final Course and as far as the Final Examination is concerned, it can be taken after completion of a minimum of 3 years of Articled Training. Management Program- A management program for a short duration, prescribed by the Institute, is mandatory to successfully complete the Chartered Accountancy course. For more information, refer to the official website of Institute of Chartered Accountants of India. |

|

#6

22nd February 2012, 01:55 PM

|

|||

|

|||

|

Chartered Accountancy is quite a complete course in it self as it give complete knowledge of handling the finance of any company or of any organization.

ANY STREAM (ARTS,COMMERCE OR SCIENCE)STUDENT CAN JOIN CHARTED ACCOUNTANCY There are three stages in CA Common Proficiency Test(CPT) IPCC Final examination Common Proficiency Test is mandatory for candidates even if they are graduate . However some exemption of CPT are there like if you are a Commerce graduates with 50% marks Non-commerce graduates with 55% marks (without maths) Non-commerce graduates with Maths with 60%. Examination will be in Paper Pencil Mode or Online Based Based Test QUALIFICATION FOR APPEARING IN CPT 10+2 PASSED There are 2 groups in IPCC GROUP I GROUP II (if you do not want to clear the group II after clearing the group I examination you can do so AND can join 3 years practical training ,after completing training you will acquire CERTIFICATE OF ACCOUNTING TECHNICAL even if you will not complete the course of CA) After clearing both IPCC (group I & II ) You can appear for final examination CA FEE C A total fee is around 40000/- to 45000/-. Pay Package Starting Salary can be expected as 3/4 lakhs per month. |

|

#8

22nd February 2012, 09:56 PM

|

|||

|

|||

|

The entry level for all the students is the same. Every student intending to take up the professional accounting course of CA (Chartered Accountancy) has to qualify in the CPT (Common Proficiency Test).

Graduate students are not provided any exemption from appearing at this level. A student is eligible to register for the CPT (Common Proficiency Test) after 10th Standard, but can appear at the examination only after appearing in the 10 + 2 examinations. There is no minimum % marks specified for entry to this level either in the 10th standard examination or the 10 + 2 examination. Moreover, students of any group can take up this course. Start/Register for CPT after 10th CPT » Common Proficiency Test [4 subjects arranged into 2 sessions of 2 hours and 100 marks each.] ↓ Appear for CPT after writing 12th Exams ↓ Register for PCC after passing both CPT & 10 + 2 PCC » Professional Competency Course [12 subjects arranged into 2 groups 3 papers each] ↓ Practical Training [As an Articled for 3 ˝ Years or As an Audit Clerk for 56 months] ITT Information Technology Training A course of 100 hour duration to be completed before being eligible to appear for the PCE ↓ Appear for PCE after completing 15 months of Training and ITT PCE » Professional Competency Examination ↓ Appear for Final [After Passing PCE and Completing Practical Training] GMC General Management & Communciation Skills Course Undergo this course simultaneously ↓ Pass Final ↓ Become an Associate Member ↓ Post Qualification Courses [Optional] |

|

#10

23rd March 2012, 11:38 PM

|

|||

|

|||

|

Quote:

All those who have completed 12th (any stream), can register for the course. A 12th pass student registered for CA course, first apply for CPT exam. (CPT- Competence Proficiency Test). The syllabus for all the exams are provided by the institute on its website and candidate has to study it on his own completely. Many students who think they require help, take help from private coaching institutes available in all major cities. |

|

#11

8th April 2012, 09:25 PM

|

|||

|

|||

|

New CHARTERED ACCOUNTANCY COURSE [CA] Details

The new Course consists of Three main levels: I. Level One: Common Proficiency Test (CPT) Registration Criteria: A student who has passed 10th standard examination may register with the Board of Studies. However the student can attempt for the CPT only after appearing for the 12th standard examination. CPT Exam Details:CPT Exam Details: CPT is an Objective type test requiring Basic Knowledge of the subjects covered. CPT will be held two times in a year: June and December. Last Dates of Registration for the CPT: For June exam last date of registration with Institute is 31st March, of every year. Students attempting the CPT exam to be held in December, every year, should be registered with the Institute on or before 1st October, every year. Subjects for the CPT: Refer below mentioned table. Session I Subjects Fundamentals of Accounting Mercantile Laws Session II General Economics Quantitative Aptitude Passing Percentage: 50% of Total marks are required to qualify the CPT. It has a flexible scheme of negative marking to the extent of 25% of incorrect answers. II. Level Two: Professional Competence Course (IPCC) and Practical Training ICAI believes in regular updation of the C.A. course to suit the fast changing environment. As part of this effort the Level Two of the course has been changed and re-christened IPCC. The details of IPCC are: Eligibility Criteria:A student who has passed the CPT and 12th standard examination may join the Integrated Professional Competence Course Practical Training: After passing group-I of the course, a student must join a practicing Chartered Accountant for practical training (Articleship). Articleship shall be of 3 years duration (36 months). Additionally: In addition to artcileship a student must complete 100 hours of Information Technology Training (ITT) and 35 hours of ‘Orientation Programme’ ITT is to be started after a student registers for IPCC and completed before appearing in Group-I and Group-II of IPCE or Group I / ATE. Orientation Programme is of 4 sessions per day for 35 hours with an ICAI accredited institute. Integrated Professional Competence Examination (IPCE): A student will have to appear for the IPCE after fulfillment of following conditions: PCE is conducted twice in a year, May and November. 1. Completion of 9 months from date of registration for IPCC. 2. Undergo Information Technology Training (ITT) provided by ICAI itself for 100 Hours. 3. Undergo the Orientation Programme conducted by ICAI for 35 Hours. Accounting Technician Course (ATC) : A student does not wish to complete erstwhile Intermediate/PE-II/PCC/IPCC can opt for Accounting Technician Course. After passing Group-I of IPCC. Subjects for the IPCC: Refer below mentioned table Eligibility Criteria:Passing Integrated Professional Competence Examination. - Undergoing General Management and Communication Skills Course. - During last six moths of completing Articleship Training of 3 years. Passing Percentage: A student will have to secure 50% marks in aggregate and 40% in each of the individual subjects. Subjects for the FINAL : Refer below mentioned table Groups Papers Subjects I 1 Accounting 2 Law, Ethics and Communication 3 Cost Accounting and Financial Management 4 Taxation II 5 Advanced Accounting 6 Auditing and Assurance 7 Information Technology and Strategic ManagementII. Level Three: C.A.Final Course Groups Papers Subjects I 1 Financial Reporting 2 Strategic Financial Management 3 Advanced Auditing and Professional Ethics 4 Company and Allied Laws II 5 Advanced Management Accounting 6 Information Systems Control and Audit 7 Direct Tax Laws 8 Indirect Tax Laws Note: A CA passing successfully through all the above requirements is the only person constitutionally permitted to perform as a CA in India. And ZPA is the only pioneering academy that provides quality coaching services at all levels of the course. Hence, its an obvious option that students select from all over India and even abroad. |

|

#16

30th May 2012, 10:18 PM

|

|||

|

|||

|

Hai...

Chartered Accountancy is quite a complete course in it self as it give complete knowledge of handling the finance of any company or of any organization. ANY STREAM (ARTS,COMMERCE OR SCIENCE)STUDENT CAN JOIN CHARTED ACCOUNTANCY There are three stages in CA Common Proficiency Test(CPT) IPCC Final examination Common Proficiency Test is mandatory for candidates even if they are graduate . However some exemption of CPT are there like if you are a Commerce graduates with 50% marks Non-commerce graduates with 55% marks (without maths) Non-commerce graduates with Maths with 60%. Examination will be in Paper Pencil Mode or Online Based Based Test QUALIFICATION FOR APPEARING IN CPT 10+2 PASSED There are 2 groups in IPCC GROUP I GROUP II (if you do not want to clear the group II after clearing the group I examination you can do so AND can join 3 years practical training ,after completing training you will acquire CERTIFICATE OF ACCOUNTING TECHNICAL even if you will not complete the course of CA) After clearing both IPCC (group I & II ) You can appear for final examination CA FEE C A total fee is around 40000/- to 45000/-. Pay Package Starting Salary can be expected as 3/4 lakhs per month. Best of luck for your future.... |

|

#20

27th July 2012, 06:58 PM

|

|||

|

|||

|

hi:

This is kumar, i finished M.B.A HR and FINANCE now i am working some private sector company, i will have do CA but i didn't know about what are all procedure and conduct the exam date, kindly i request to all pls rise up and guide my life sir |

|

#30

10th November 2012, 04:25 PM

|

|||

|

|||

|

The Chartered Accountants Program combines two components: Postgraduate accounting qualifications (Graduate Diploma of Chartered Accounting) Practical Experience, under the guidance of a mentor. This combination produces Chartered Accountants with superior technical skills, outstanding professional competence and an exciting future. |

|

#31

10th November 2012, 06:59 PM

|

|||

|

|||

|

Hello,

Well it is good that you are opting for Chartered Accountancy course, but are you from commerce genre at all. See CA or Chartered Accountancy course is a very difficult course, so if you are not from commerce domain in your prior education, you may suffer problem when you enter this course. So it is better that you go for this course, right after your B.Com. Now after that you need to sit for the entrance examination of CA which is called CPT or Common Proficiency Test. The test consists of 2 hours. It is a objective type question paper to be answered on an OMR sheet. You will need to cover aptitude, accounts, mercantile laws and general economics to participate in CPT. After you clear CPT, you go for the two professional courses of CA, each 10 months long. After clearing both the courses you will be hailed as a CA or chartered accountant. |

|

#32

11th November 2012, 12:00 AM

|

|||

|

|||

|

Chartered Accountant Course :

CA Eligibility : Candidates must complete 12th stands with min 55% aggregate from a recognized university CA have Three courses CPT IPCC Final Exam

|

|

#35

1st December 2012, 12:52 AM

|

|||

|

|||

|

Now a days CA's have the good position.

Am providing some information about CA. This course have three stages they are 1.CPT 2.IPCC 3.CA FINAL 12th standard candidates are first write the CPT exam and after this exam those are eligible for next stage. Graduate candidates are directly join in IPCC. After completion of this course that candidate should register in CA FINAL. The candidate must do the article ship since two years at CA. |

|

#38

26th January 2013, 12:58 PM

|

|||

|

|||

|

I have completed articleship of 3 years in 2004 and passed group I. I have not appeared for exams next. Now i want to continue the same. Is that possible to continue after getting exemption of group I. Plz inform me.

|

|

#41

5th March 2013, 01:39 PM

|

|||

|

|||

|

Hi...

Friends, Present day's CA course have the good option. CA Course have a 3 Stages like :: ========================== *** CPT *** IPCC *** Final stage. *** The candidates must be complete 12th stand and write CPT exam, are eligible for for next stage. *** The Graduation candidates directly IPCC course join. *** After complete of this course that candidates should register to CA Final. *** CA course since 2 years. All the best.............................. |

|

|