|

#1

18th January 2013, 02:51 PM

|

|||

|

|||

How to enter in CA after passing 10th standard?

how to enter in CA after 10th standard?...pelase tel me the details for the same

|

|

#2

19th January 2013, 02:33 PM

|

|||

|

|||

|

Hello my friend,

If you mean CA as charted accountant. Then after your 10th take commerce in PU then do your B.Com and then you can study CA. If you mean CA as Computer Application. Then you can take either science stream with PCMC as your combination or go with commerce also.After completing your PU you can do BCA.Then go with MCA. All the Best |

|

#3

27th January 2013, 11:15 PM

|

|||

|

|||

|

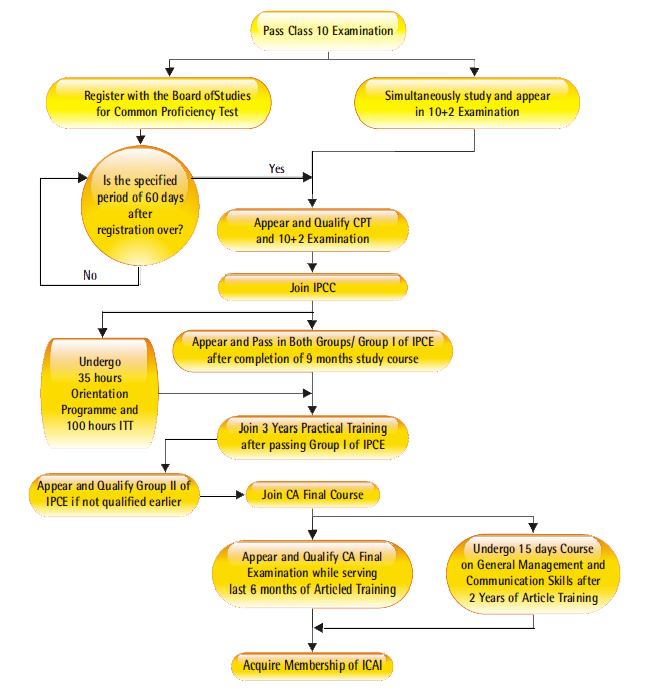

my friend,

If you mean CA as charted accountant. than first you register for cpt exam. After passing cpt exam you eligeble for ipcc exam. After ipcc exam you eligeble for article ship. After this last exam of ca final exam,after this you become a CA |

|

#4

22nd February 2013, 10:01 PM

|

|||

|

|||

|

i am so confused to choose the stream in 11th standard after my passing the exams of 10th standard. I have little bit interest in chemistry, physics and mathematics but i am not to good in chemistry and physics.

|

|

#5

22nd February 2013, 11:18 PM

|

|||

|

|||

|

Hi, You cannot apply for CA course just after class 10th. The minimum qualification required for CA is 10 + 2. CA- Chartered Accountant The entrance exam is conducted by ICAI and this exam is known as CPT – Common Proficiency Test. Eligibility for CPT - 1. Candidate should have completed Senior Secondary Examination (10+2) from a recognised board. Students waiting for (10+2) results can also apply. 2. Candidate can join CA after (10+2) or graduation. 3. There is no restriction in terms of age or percentage secured in (10+2). Common proficiency test is conducted 2 times in a year in the months of June and December. Syllabus for CPT – It is a 2 hours exam and is divided into 2 sessions each. CPT is an objective type 200 marks exam with negative marking for wrong answers. Minimum qualifying marks are 50% in CPT. So, first you should complete your intermediate and then you can sit for CPT exam for admission in CA course. |

|

#6

23rd February 2013, 09:17 AM

|

|||

|

|||

|

Hi dear............

That's a good decision , you are interested to do CA i.e Chattered Accountant Course which is conducted through Institute of Chattered Accountant of India . The course structure ....  First of all you have to register for CPT , Then IPCC or Inter along with you have to complete your ITT , Orientation Class & Article ship. For more details log on to.. http://www.icai.org Good luck............... |

|

#7

23rd February 2013, 10:23 AM

|

|||

|

|||

|

Hello friend,

>> Educational qualification - After 12th you can join CA is possible. - 10+2 (Commerce) passed in Recognized board with 50% marks. >> Detail in CA courses - CA course is complete in 4.5 years. >> CA course( Three level) > Level One: Common Proficiency Test Session I 1) Fundamentals of Accounting 2) Mercantile Laws Session II 1) General Economics 2) Quantitative Aptitude > Level Two: Professional Competence Course and Practical Training - Group I = Cost Accounting and Financial Management = Taxation = Accounting = Law, Ethics and Communication - Group II = Auditing and Assurance = Advanced Accounting > Level Three: C.A.Final Course All the best |

|

#8

23rd February 2013, 10:31 AM

|

|||

|

|||

|

Hi friend,

>> Eligibility - After 12th you can join CA is possible. - you get in 12th Commerce minimum 60% required. >> CA course( Three level) > Level One: Common Proficiency Test Session I 1) Fundamentals of Accounting 2) Mercantile Laws Session II 1) General Economics 2) Quantitative Aptitude > Level Two: Professional Competence Course and Practical Training - Group I = Cost Accounting and Financial Management = Taxation = Accounting = Law, Ethics and Communication - Group II = Auditing and Assurance = Advanced Accounting > Level Three: C.A.Final Course All the best |

|

|