|

#1

18th August 2012, 08:53 AM

|

|||

|

|||

Procedure to join CA course after completion of B.Com course?

i had completed my b.com and want to do C A so ,will you please help me.... i am yasmeen.

|

|

#2

18th August 2012, 11:54 AM

|

|||

|

|||

|

Hi Friend...........

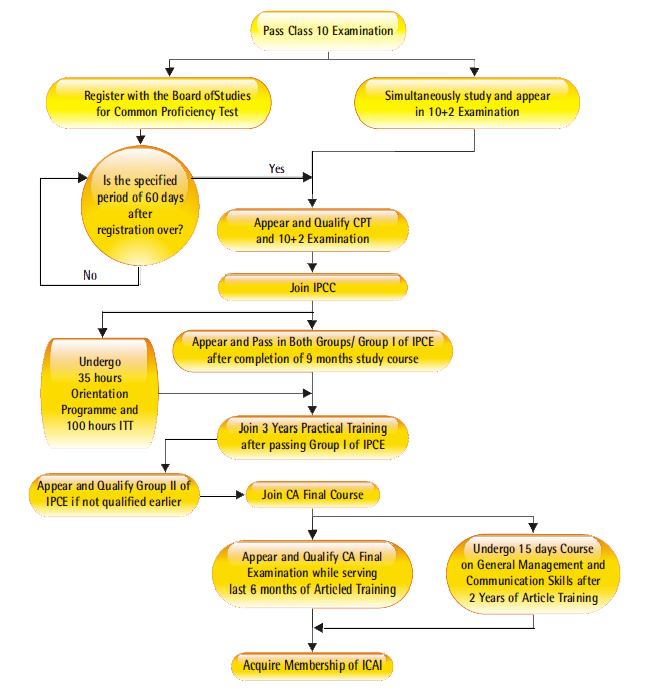

CA - Chartered Accountant Course CA have 3 stages i.e. ** CPT ** IPCC ** Final if you are complete your graduation in Commerce successfully, you are eligible to direct registered into IPCC Course without CPT CPT Exempt for graduate students from 1st August, 2012 IPCC have 2 Groups 1st Group have 4 subject 2nd Group have 3 subject after complete IPCC you compulsory complete the article ship minimum 2 years after completion of you article ship, you are eligible for Final course.. thanking you, all the best.............. Regards......... Tash |

|

#3

18th August 2012, 12:28 PM

|

|||

|

|||

|

Hi Friend,

The Chartered Accountancy course comprises of 1. Competence Proficiency Test or CPT 2. Integrated Proficiency Competence Course or IPCC and 3. Final Course One can apply for CPT during 12th class or after passing 12th board exams. After qualifying CPT, you will become eligible for IPCC. You can get exemption from CPT and can directly apply for IPCC if you have scored 50% or more marks in B.Com. There is no strict duration of course. If you pass all the exams in one attempt and do not waste time in any case then it should take approximately 5-6 years to complete the course. The IPCC is divided into two groups (Group-A and Group-B) You can apply for Group-A and Group-B exams in the same session or in different sessions. After passing both groups of IPCC you will have to undergo 3 year Articled Training. After completion of Articled Training or during the last year of Articled Training, you can apply for CA Final Course exam. I hope these information will help you. All the very best.............. |

|

#4

18th August 2012, 01:34 PM

|

|||

|

|||

|

The role of chartered accountants is to prepare the audit of financial statements of the companies/firms as per the Companies Act of 1956 and Income Tax Act of 1961. However that's not all what a Chartered Accountant do. The areas of expertise of CA include Taxation, management accounting, arbitration, corporate law etc.

An Chartered Accountant may choose to work for firms or independently depending on the his choice. To become Chartered Accountant in India, every candidate is required to complete the course offered by the The Institute of Chartered Accountants of India (ICAI) which was established in 1949. There are three stages of Chartered Accountacy course. It is considered as very difficult course because every year only 15 percent of the total candidates manages to pass the Chartered Accountacy course. Common Proficiency Test (CPT) The first stage of the CA course is CPT or Common Proficiency Test. This exam is of 200 marks and candidates are required to obtain at least 100 marks to pass it. There are four stages of this exam: 1. Fundamentals of Accountancy 2. Economics 3. Mercantile Law 4. Quantitative Aptitude Eligibility: Any student who has passed 10th or 12th is eligible to appear in CPT Exam. However not every B.Com degree holder is required to appear in this exam. The reason would be explained in the second stage mentioned below. Integrated Professional Competancy Test (IPPC) Integrated Professional Competancy Test (IPPC) is the second stage of the CA Exam. Due to the recent changes made by the ICAI, students can skip the CPT Exam and directly go for IPCC but only if you meet the following requirements. Eligibility: You need to have B.Com degree with at least 55 percent marks. Those who have completed graduation course in some other stream need at least 60 percent marks to get direct admission for IPCC. It is easy to pass the first and second stage of CA course. It is the third stage which is difficult to pass. The third stage is divided into two sections. Section 1 1. Financial Reporting 2. Strategic Financial Management 3. Advanced Auditing and Professional Ethics 4. Corporate and Allied Laws Section 2 5. Advanced Management Accounting 6. Information System control and Audit 7. Direct Tax Laws 8. indirect tax Laws |

|

#5

18th August 2012, 01:55 PM

|

|||

|

|||

|

Hi dear.............

The CA course structure :-  As you are a graduate you can direct join to IPCC . The eligibility criteria are as follows....... *The candidates should be a graduate , for commerce students 55% Non commerce students 60 %. *The candidates those who are passed inter in ICAI , ICSI . They can also join in this course. The Fees structure of CA course & Duration....  For more details visit officiail website of ICAI. http://www.icai.org good luck.............. |

|

#8

20th July 2013, 07:44 PM

|

|||

|

|||

|

Quote:

Dear Friend , C.A is the very popular & brighter scope of the make your career. C.A stands for the Charter Accountant. C.A conducted by the I.C.A.I. C.A is very useful in the Government & Private sector both. After the B.Com if you join the C.A then you have Follow the C.A's simple 3 level which are as under :- 1. C.P.T stands for the Common Proficiency Test. 2. I.P.C.C. level. 3. Final Level. If you have the any Query in the account subject then please Click here. with best wishes of makes 25.  |

|

#10

19th April 2014, 10:34 PM

|

|||

|

|||

|

Hi I complete my HSC Commerce Group with 75% UG is Bsc it with 78% and Now i am doing MBA Final year i would like to join CA Course. [email protected] this is my mail id send further information thank u

|

|

|